Annual Giving Campaign

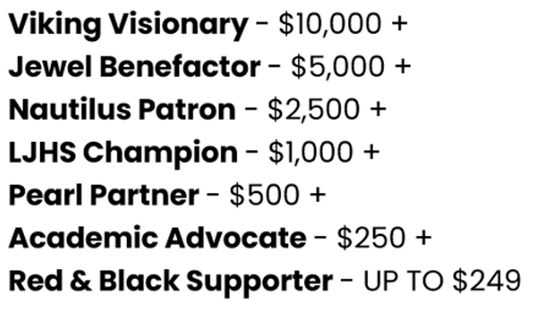

Each year, our Annual Giving Campaign raises money to support the General Fund, which benefits every student at LJHS and offers the most flexibility for directing resources to our school's greatest needs. Our goal is 100% participation from our families. No amount is too small. Every dollar counts. Please consider making a tax-deductible donation of any size.

We have many ways to donate - credit/debit card, check, PayPal, Zelle. See below for details. Don't forget about company match programs, as well as donations of appreciated stock or from your Donor Advised Fund or IRA (if 70.5 years+).

We have many ways to donate - credit/debit card, check, PayPal, Zelle. See below for details. Don't forget about company match programs, as well as donations of appreciated stock or from your Donor Advised Fund or IRA (if 70.5 years+).

Donation by credit/debit card

Complete online form with donation information.

Complete online form with donation information.

Donation by check (personal, charitable account, bank-issued online check)

Make check payable to Foundation of La Jolla High School, Inc.

Mail to Foundation of La Jolla High School at 750 Nautilus Street, La Jolla, CA 92037.

*Please include the name by which you would like to be recognized on our donor board and an email address to receive receipt/tax letter

Donation by Zelle

Payment to [email protected]

*Please include the name by which you would like to be recognized on our donor board and an email address to receive receipt/tax letter.

Donation by PayPal

Payment to [email protected]

*Please include the name by which you would like to be recognized on our donor board and an email address to receive receipt/tax letter.

Any questions? Contact Katy Siddons, Annual Giving Campaign Chair at [email protected].